For most Americans, filing taxes can be a painstaking process.

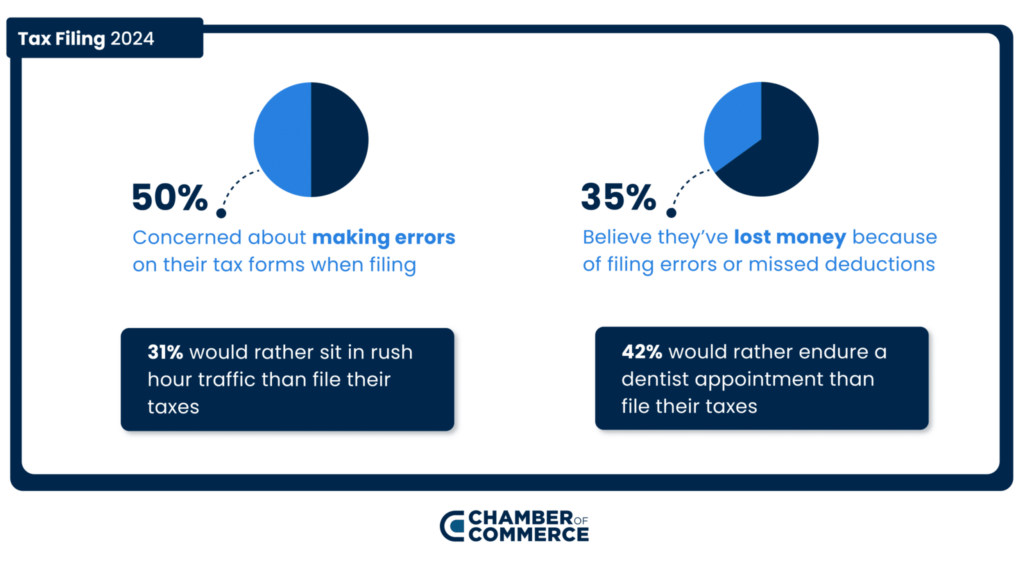

Considering 42% of Americans say they’d rather endure a dentist appointment than file their taxes, it’s an understatement to say that most people don’t look forward to tax season.

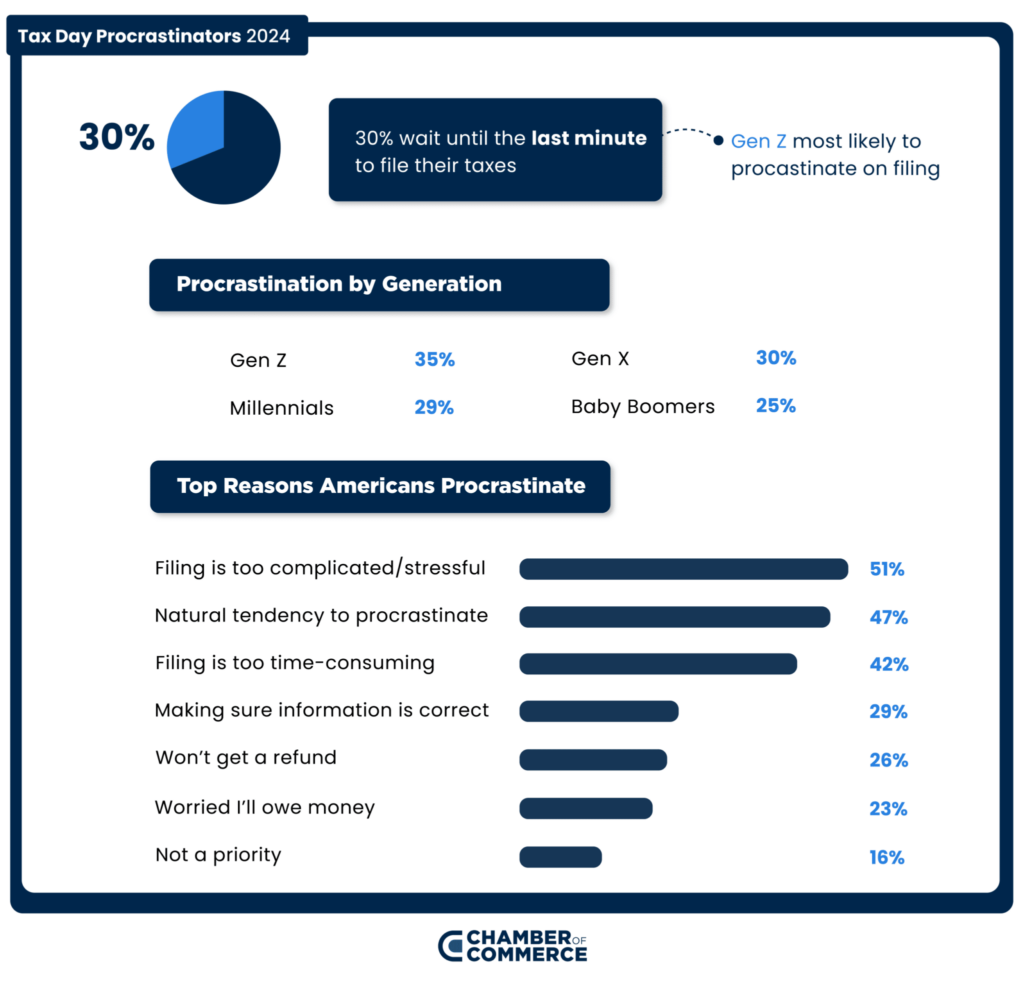

This year, tax season officially begins on Jan. 29, 2024, but our nationwide survey shows that nearly 3-in-10 (30%) of Americans procrastinate and wait until the last minute to file their taxes.

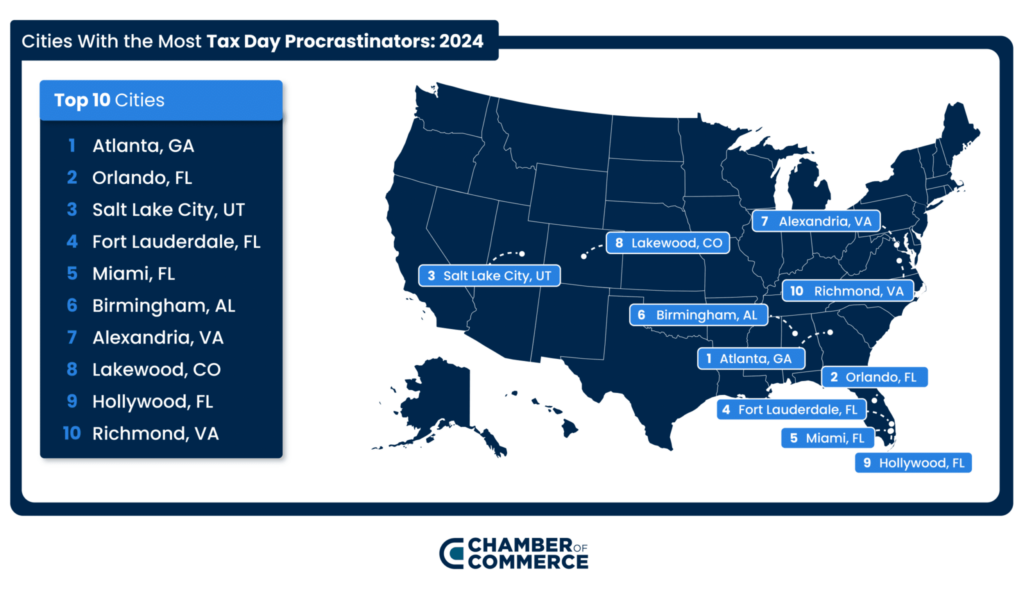

But which cities are home to the biggest procrastinators when it comes to filing taxes before the April 15 Tax Day deadline?

To find out, we surveyed Americans and analyzed Google search volume related to filing taxes late in more than 170 cities across the country. Our analysis included terms such as “can you file your taxes late?”, “file tax extension,” “missed tax deadline,” “penalty for late taxes” and other keyword variations.

Our “Tax Day procrastination” study also gathered feedback from Americans on their experiences with tax filing, why they procrastinate on their taxes, and what type of tax refund they expect to receive in 2024.

Key findings

- 30% of Americans admit to procrastinating and waiting until the last minute to file their taxes.

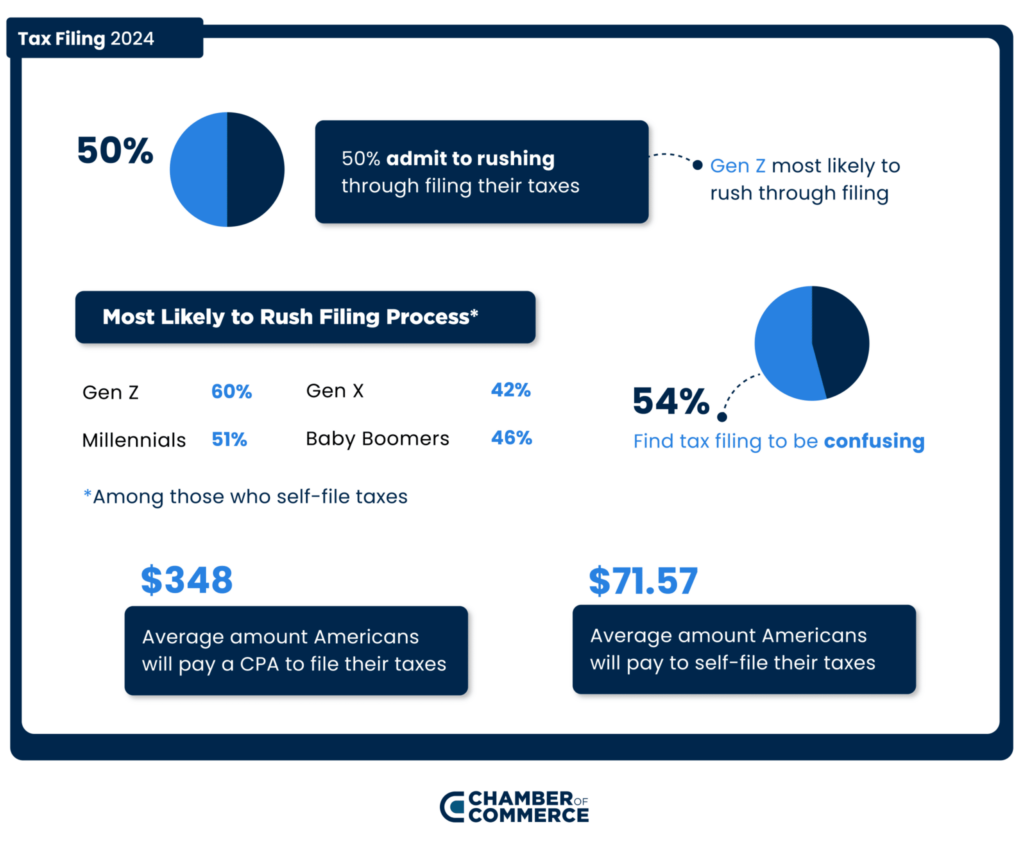

- 50% confess to rushing through the filing process in order to complete their taxes as quickly as possible.

- For the second consecutive year, Atlanta, GA (No. 1), Orlando, FL (No. 2), Salt Lake City, UT (No. 3), Fort Lauderdale, FL (No. 4) and Miami, FL (No. 5) have all made the top 5 list of cities with the highest levels of tax filing procrastinating.

- On average, Americans expect to receive a refund of $2,009 this year.

- Surprisingly, more than 2-in-10 (22%) don’t know that Tax Day falls on April 15.

Tax Day 2024: Which cities procrastinate the most on tax filing?

To determine where Americans drag their feet the most when it comes to filing their taxes, our analysis focused on search volume related to late tax filing in more than 170 cities with a population of 150,000 or more.

In the overall ranking, Florida stands out with four cities securing positions in the top 10 for Tax Day procrastination. Orlando was ranked No. 2, while Fort Lauderdale ranked No. 4, Miami ranked No. 5, and Hollywood came in at No. 9.

Among the top 50 cities, Florida and California cities dominate the list. California has six cities within the top 50, while Florida has five. Elsewhere, three Colorado cities cracked the top 50, including Lakewood (No. 8), Denver (No. 20), and Fort Collins (No. 27).

Washington also had a notable presence for procrastination, with three cities among the top 50, including Seattle (No. 19), Vancouver (No. 21), and Tacoma (No. 24). Cities with the most Tax Filing procastinators: 2024

Why Americans procrastinate on filing taxes

Our survey from last year revealed that 31% of Americans say they wait until the last minute to file their taxes, and the motivation to file hasn’t seen much improvement. According to our 2024 nationwide survey, 3-in-10 (30%) procrastinate on filing their taxes.

Once again, Gen Z remains the most likely generation to put off filing their taxes, with more than one-third (35%) of Gen Z respondents stating that they wait until the last minute to file.

In contrast, Baby Boomers emerge as the least likely to procrastinate on filing their taxes, with only a quarter of Baby Boomer respondents saying they wait until the last minute.

The primary reason Americans procrastinate on filing is because they find the process to be too complicated and stressful (51%). Additionally, 47% say they have a natural tendency to procrastinate, and 42% say filing taxes is just too time-consuming, so they put it off until the final hour.

Tax Day 2024: Filing taxes

Whether you’re filing taxes early or late this year, it’s not a good idea to rush through the filing process. Rushing increases the risk of missing out on deductions, potentially reducing your refund, and it can also lead to errors.

Despite the risks, half (50%) of Americans who self-file their taxes admit to rushing through the process. Additionally, 48% of procrastinators who self-file also admit to getting them done as quickly as possible.

When asked what they’d rather endure rather than filing taxes, 31% said they’d rather sit in rush hour traffic, while 42% would opt for a dentist appointment.

For those expecting a tax refund this year, Americans expect to receive roughly $2,009.

How does that compare to what Americans received in 2023? According to the Internal Revenue Service (IRS), the average refund in 2023 was $2,753, while the average in 2022 was $3,012.

When is Tax Day 2024?

It’s one thing to procrastinate on filing your taxes, but it’s another to completely miss the Tax Day deadline altogether. This year, Tax Day is April 15, 2024. However, more than 2-in-10 (22%) of respondents don’t know this year’s tax filing deadline.

Whether you’re a procrastinator or a tax filing early bird, make sure you’re not joining the 50% of Americans who rush through filing their taxes. Taxes can be confusing and overwhelming. If you’re not feeling confident about filing your own taxes, consider reaching out to a trusted Certified Public Accountant (CPA) before their schedules get booked up this season. Seeking professional assistance can help ensure accurate and efficient tax filing, providing peace of mind during tax season.

Methodology

To determine our ranking, we analyzed more than 170 census-defined places with a population of 150,000 or more via the U.S. Census Bureau. We then analyzed Google search volume in each city for terms and keywords related to filing taxes late such as “can you file your taxes late?”, “file tax extension,” “missed tax deadline,” “penalty for late taxes” and other variations. Total search volume was then calculated per capita and ranked per 100,000 people in each city.

In January 2024, we surveyed 1,500 Americans to ask them about their experience with filing taxes. 55% of respondents were female, 42% were male and 3% were non-binary/non-conforming. The average age of respondents was 41.

Income: Under $20K (15%); $20,000-$39,999K (19%); $40,000-$59,999 (19%); $60,000-$79,999 (17%); $80,000-$99,999 (11%); $100K or over (19%).

Sources: U.S. Census Bureau, Internal Revenue Service, Pew Research Center, Google search volume analysis

Fair Use: Feel free to use this data and research with proper attribution linking to this study.

Media Inquiries: For media inquiries, contact media@thisisnoble.co

0 Comments