Our blog

Foreign assets or transactions: 720, ETE and D-6

Statements of foreign assets or transactions for residents in Spain We have in Spain three different compulsory reports of foreign assets or transactions abroad: the Modelo 720 of the Spanish Tax Agency, the modelo ETE from the Bank of Spain, and the D-6 of the...

Due dates of 2021 Fiscal obligations for US Citizens living in Spain.

The 4 fiscal obligations for expats in Spain. All U.S. Citizen you are required to file a U.S. Individual Tax Return every year, wherever in the world they live, reporting your worldwide income, even if you pay taxes in Spain. You must file (1) the Form 1040...

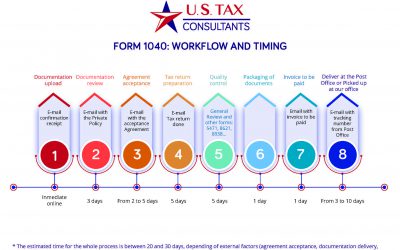

NEW TRACKING MODEL SYSTEM. KNOWING ANY TIME, THE PREPARATION STATUS OF YOUR RETURN.

In order to offer a better service, U.S. Tax Consultants has developed an information system that allows our clients to know in which phase of the preparation process your return is. A process that consists of eight different phases and of which the client will be...

Treasury and IRS will begin delivering second round of Economic Impact Payments to millions of Americans on January 4, 2021

The Internal Revenue Service and the Treasury Department will begin delivering a second round of Economic Impact Payments on January 4th, as part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 to millions of Americans who received the...

‘It’s Unacceptable,’ IRS Still Processing Millions Of 2019 Tax Returns

BOSTON (CBS) — With the uncertainty surrounding the coronavirus, Keith Wortzman would love to have his 2019 tax refund of several thousand dollars in the bank. “Any refund helps. They actually say it’s not a refund, it’s money that you overpaid,” he told WBZ-TV. But...

“Accidental Americans” in Europe against FATCA and its reporting.

The Association of Accidental Americans (AAA) has filed two legal complaints simultaneously in Belgium and Luxemburg to demand the “immediate halt to the transfer of European citizens’ personal data to the United States”. The claims relate to the countries’ adherence...

Spanish Taxes for expats and Accountancy Services

Spanish & International Tax and Accountancy Services since 1956, U.S. Tax Consultants has guided expats residents in Spain with their taxes and all other fiscal issues. We annually prepare Spanish Tax Returns, Modelo 720, quarterly report for autonomos and...

ITIN and its application process

TIN and its application process. All nonresident aliens require an ITIN to file an U.S. Individual Income Tax Return. An IRS individual taxpayer identification number (ITIN) is for U.S. federal tax purposes only. If you are a U.S. Citizen, you must use your SSN...

Six Need-To-Know 2020 Tax issues for expats.

We have selected that six need-to-know tax issues for expats to bear in mind before preparing their US Tax Returns: Mutual Funds, US bank account, CTC, tax preparation, Streamline Procedure and how to pay the IRS 1. “Fondos de Inversión” outside the U.S. All US...

Looking for Sustainability in US Tax Consultants

With a responsible use of paper, recycle, reduce electricity, sustainable suppliers and office plants… We are looking for sustainability. Looking for sustainability, U.S. Tax Consultants have lots of reasons to implement sustainable practices in our workplace, not...

Stimulus Check: The IRS might owe 9 million people a catch-up payment

If you're still waiting for your first stimulus payment, there are several ways to hunt it down. As many as 9 million people were eligible for a first check but didn't receive the payment because they needed to register with the IRS -- an extra step most people didn't...

AMERICAN WEEK – US Election Debate for expats

The University San Pablo CEU (Alumni) and the American Club of Madrid have organized an American week which includes an Election Debate: Republican vs Democrats on Oct 28 AMERICAN WEEK- OPENING CEREMONY OCTOBER 28, 2020 Zoom Link:...

IRS extends Economic Impact Payment registration deadline for non-filers to Nov. 21

The deadline to register for an Economic Impact Payment using the Non-Filers tool is extended to November 21, 2020. The IRS urges people who don't typically file a tax return – and haven't received an Economic Impact Payment – to register as quickly as possible using...

Find out if you have missing money or any unclaimed property

Every year states receive lost and unclaimed money, property or other assets, and the National Association of Unclaimed Property Administrators – NAUPA helps them find the rightful owners. It costs nothing to search, it's FREE. Conduct your free search for bank...

Measures we have taken to face the COVID-19 pandemic

As one of the stakeholders of the economy, US Tax Consultants has assumed its social responsibility to guarantee the safety and proper organization of all its employees and the clients who visit us. At this time, due to the various strategic and operational risks that...

FBAR Penalties 2020

In 2019-2020, FBAR Penalty Enforcement is at an all-time high. If a person does not timely file their annual FBAR with FinCEN in the current year, they may be subject to FBAR Penalties -- but the penalties may be reduced or even eliminated through reasonable cause or...

IRS payment options and other tools

Taxpayers have a variety of options to consider when paying federal taxes. This year, in response to the COVID-19 pandemic, the filing deadline and tax payment due date was postponed from April 15 to July 15, 2020. All payment options are available...

How soon the IRS could send the second stimulus checks

The White House has a plan to send your second stimulus payment faster than the first check went out. We worked out some possible dates of when this might happen, whenever Washington agrees on a new stimulus package. The debate over the next stimulus package seemed no...

CARES Act 2: When could the IRS send the second stimulus check?

What is today's status on the next check for Americans and how soon could you get the second payment from the IRS? The Senate proposal for the next stimulus package will be revealed on Monday, according to Senate Majority Leader Mitch McConnell and it will come with...

The IRS continues to help people with low income or no income get an Economic Impact Payment

This special edition of Outreach Connection is dedicated to resources and materials aimed to help reach millions of low-income people, the homeless and others who aren’t required to file a tax return but may be eligible for an Economic Impact Payment of $1,200 or...

Recent Comments