Our blog

Looking for Sustainability in US Tax Consultants

With a responsible use of paper, recycle, reduce electricity, sustainable suppliers and office plants… We are looking for sustainability. Looking for sustainability, U.S. Tax Consultants have lots of reasons to implement sustainable practices in our workplace, not...

Stimulus Check: The IRS might owe 9 million people a catch-up payment

If you're still waiting for your first stimulus payment, there are several ways to hunt it down. As many as 9 million people were eligible for a first check but didn't receive the payment because they needed to register with the IRS -- an extra step most people didn't...

AMERICAN WEEK – US Election Debate for expats

The University San Pablo CEU (Alumni) and the American Club of Madrid have organized an American week which includes an Election Debate: Republican vs Democrats on Oct 28 AMERICAN WEEK- OPENING CEREMONY OCTOBER 28, 2020 Zoom Link:...

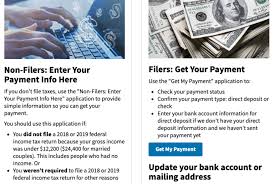

IRS extends Economic Impact Payment registration deadline for non-filers to Nov. 21

The deadline to register for an Economic Impact Payment using the Non-Filers tool is extended to November 21, 2020. The IRS urges people who don't typically file a tax return – and haven't received an Economic Impact Payment – to register as quickly as possible using...

Find out if you have missing money or any unclaimed property

Every year states receive lost and unclaimed money, property or other assets, and the National Association of Unclaimed Property Administrators – NAUPA helps them find the rightful owners. It costs nothing to search, it's FREE. Conduct your free search for bank...

Measures we have taken to face the COVID-19 pandemic

As one of the stakeholders of the economy, US Tax Consultants has assumed its social responsibility to guarantee the safety and proper organization of all its employees and the clients who visit us. At this time, due to the various strategic and operational risks that...

FBAR Penalties 2020

In 2019-2020, FBAR Penalty Enforcement is at an all-time high. If a person does not timely file their annual FBAR with FinCEN in the current year, they may be subject to FBAR Penalties -- but the penalties may be reduced or even eliminated through reasonable cause or...

IRS payment options and other tools

Taxpayers have a variety of options to consider when paying federal taxes. This year, in response to the COVID-19 pandemic, the filing deadline and tax payment due date was postponed from April 15 to July 15, 2020. All payment options are available...

How soon the IRS could send the second stimulus checks

The White House has a plan to send your second stimulus payment faster than the first check went out. We worked out some possible dates of when this might happen, whenever Washington agrees on a new stimulus package. The debate over the next stimulus package seemed no...

CARES Act 2: When could the IRS send the second stimulus check?

What is today's status on the next check for Americans and how soon could you get the second payment from the IRS? The Senate proposal for the next stimulus package will be revealed on Monday, according to Senate Majority Leader Mitch McConnell and it will come with...

The IRS continues to help people with low income or no income get an Economic Impact Payment

This special edition of Outreach Connection is dedicated to resources and materials aimed to help reach millions of low-income people, the homeless and others who aren’t required to file a tax return but may be eligible for an Economic Impact Payment of $1,200 or...

How and when you should report your no-show stimulus check to the IRS

Getting tired of waiting for your lagging stimulus check is one thing. But if you truly think it's gone missing, we can provide some information about important next steps. Still no stimulus check? Your first instinct might be to contact the IRS to report your late...

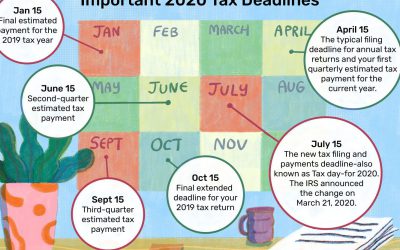

The important US Income Tax Return Deadlines for this year 2020

The official tax deadline to file your federal income tax return each year can be a little shifty. Yes, it's supposed to be April 15—unless something interferes with that timing, like the date falling on a weekend or a holiday. Tax deadlines are moved to the next...

The Economic Impact Payment figures up to May 22, 2020

The Treasury Department and the Internal Revenue Service released updated state-by-state figures, including Foreign Addresses, for Economic Impact Payments reflecting the opening weeks of the program. "Economic Impact Payments have continued going out at a rapid rate...

U.S. Tax Consultants Opening in Portugal

Although we already had clients in that market, we want to get our solutions and know-how to more U.S. expatriates residing in Portugal. To do this we started a campaign on social networks informing about the services of our company. One more step in the long history...

Form 1040 – US Individual Tax Return for all US citizens

You must file a Form 1040 is you are a US Person (US citizens, Green Card holders and resident Aliens), no matter where you live or if you pay taxes in a foreign Country. Normally the deadline for filing is April 15th but this year has been extended for everybody...

Modelo 100 IRPF – Spanish Income Tax Return and Wealth Tax (Modelo 714) for residents in Spain

The deadline for filing the Spanish return this year will be from April 1 to June 30. The coronavirus does not alter the initial calendar of the AEAT to liquidate the Personal Income Tax and Wealth Tax. One of the novelties this year is that the identification of the...

Why you were not able to get your “stimulus check”.

Many American citizens living abroad have not yet received pandemic relief payments because of administrative and technical difficulties. In a letter sent a few days ago, American Citizens Abroad (ACA) urged the IRS to streamline the application process and to mount a...

All you need to know about the Economic Impact Payments – “Stimulus Check”

Who Is Eligible and How Much Will You Get? You are eligible if you are US citizen and US residents Aliens with a valid SSN, could not be claimed as a dependent of another taxpayer and had Adjusted Gross Income (AGI) under certain limits. It does not matter where you...

Economic Impact Payments – “Stimulus Check” Update your bank account or mailing address

The IRS is committed to helping you get your Economic Impact Payment as soon as possible. The payments, also referred to by some as stimulus payments, are automatic for most taxpayers. No further action is needed by taxpayers who filed tax returns in 2018 and 2019 and...

Recent Comments