Our blog

What is the IRS three-year rule and how does it affect your taxes?

The IRS three-year rule establishes a three-year window from the date you file your tax return or the due date of the return, whichever is later.

People exempt from filing their income tax return in Spain in 2025.

The 2024-2025 income tax campaign will begin on April 2, and citizens will have until June 30 to process their returns, tax payments are done in two instalments: 60% in June 30 and the other 40% in November 6, 2025.

Tax season 2025: Everything you need to know about deadlines, refunds, audits and more

Brace yourself. It’s tax season. Starting Jan. 27, the Internal Revenue Service will once again begin accepting and processing 2024 returns.

IRS announces Jan. 27 start to 2025 tax filing season

The IRS announced that the nation’s 2025 tax season will start on Jan. 27, 2025, and will feature expanded and enhanced tools to help taxpayers.

A Faster and More Convenient Way to Request a Social Security Number and Card

January 10, 2025 • By BJ Jarrett, Acting Deputy Associate Commissioner Do you need an original Social Security number or a replacement Social Security card? We offer a faster and more convenient way for you to start – and possibly finish – the application online. When...

The New Tax Season 2025 is Coming Soon

When does tax filing season start? A new year can mean many new, exciting things. But it also means that tax season is just around the corner. Soon Americans will have to do the yearly task of filing their tax returns for the previous year. For some, it's a walk in...

Accidental Americans

“Accidental Americans” are people who, although they have not lived in the United States and have no direct link to the country, have U.S. citizenship due to factors such as being born in U.S. territory or having one of their parents be an American citizen.

Modelo 720 and its repercussions on Modelo 100 and 714

Modelo 720, established by the Spanish Tax Administration Agency (AEAT), is an informative declaration that requires Spanish taxpayers who own assets and rights abroad with an aggregate value of more than €50,000 to report these assets.

Taxation of U.S. Citizens and Resident Aliens (Green Card Holders) Living Abroad

U.S. citizens or resident aliens are subject to tax on worldwide income from all sources and must report all taxable income and pay taxes according to the IRC.

Deadline to claim the 2021 Recovery Rebate Credit

IRS announces special payments this month to 1 million taxpayers who did not claim 2021 Recovery Rebate Credit. The IRS encourages non-filers about approaching deadline to claim credits. As part of continuing efforts to help taxpayers, the Internal Revenue Service...

New Residency Based Tax Bill Introduced in the House of Representatives

From Democrats Abroad December , 2024 Democrats Abroad welcomes the introduction of the Residence-Based Taxation for Americans Abroad Act from Congressman Darin LaHood (R-IL-16). Years of commitment and dedication by Democrats Abroad has laid important groundwork to...

Información general de los servicios y lista de documentos necesarios

Haz clic en los siguientes enlaces para acceder a la información Form 1040 Q&A – Declaración individual de impuestos en EE.UU. (IRS) FinCEN 114 Q&A – Declaración de cuentas bancarias en el extranjero (FinCEN) Foreign Offshore Streamlined Procedure Q&A –...

General information of services and list of documents required.

General information of services and list of documents required. Click on the following links to access the information: Form 1040 Q&A – U.S. Federal Individual Tax Return (IRS) FinCEN 114 Q&A – Foreign Bank Account Report (FinCEN) Foreign Offshore Streamlined...

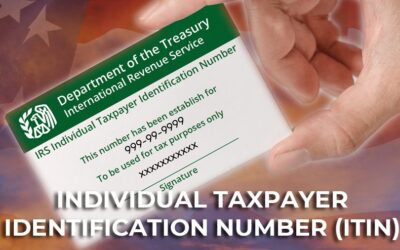

INDIVIDUAL TAXPAYER IDENTIFICATION NUMBER (ITIN)

Why do I need an ITIN? An Individual Taxpayer Identification Number (ITIN) is a 9-digit number the Internal Revenue Service (IRS) issues to people filing a tax return who are not U.S. citizens and who do not have or are not eligible for a Social Security number. You...

Inheritance and Gift Tax with non-residents.

The application of regional regulations on Inheritance and Gift Tax by a non-resident taxpayer is a right and not an option. Every tax option must describe a regulatory alternative, consisting of choosing between different and exclusive tax legal regimes. In cases...

New deduction for investments for non-residents. Comunidad de Madrid

New deduction for investments for non-residents who become IRPF taxpayers in the Autonomous Community of Madrid. The deduction will amount to 20% of the acquisition value of certain assets and will require maintaining the investment and residence for several years....

Why Use a Tax Preparer for All Your Tax Needs?

US Tax Consultants offers a free, no-obligation consultation through our website. We specialize in taxes in both the United States and Spain, and we understand the difficulties and challenges of having tax obligations in both countries. With deep knowledge of the...

Modelo 720 y 721 Declaración de bienes en el extranjero 2024

Modelo 720 y 721 Declaración de bienes en el extranjero 2024

Modelo 720 and 721 Report of Assets Abroad 2024

How to Report IRA and ROTH IRA Accounts in Spain?

In this article on "How to Report IRA and ROTH IRA Accounts in Spain? we will analyze how IRA and ROTH IRA accounts are taxed under IRPF and Wealth Tax, and whether they need to be reported in Form 720. Obligation to Report on Form 720 An American citizen who is a tax...

Recent Comments