Our blog

ACM Webinar: “All you need to know about the Inhertance Law for Expats Residents in Spain.”

ACM Webinar, May 26th, 2021 at 19:00 “All you need to know about the Inhertance Law for Expats Residents in Spain.” Organized by the American Club of Madrid and Goy GENTILE Abogados The American Club of Madrid will continue this season’s Webinars with a detailed...

IRS is holding millions of tax returns, delaying refunds

By Aimee Picchi - CBS News April 25th The IRS is holding 29 million tax returns for manual processing, delaying tax refunds for many Americans, according to the National Taxpayer Advocate, an independent arm of the tax agency that looks out for consumers' interest....

Modelo 100 IRPF

Spanish Income Tax Return modelo 100 IRPF for residents in Spain and Wealth Tax (Modelo 714) for residents and owners of good or right located in Spain. All Spanish fiscal residents must file Modelo 100 IRPF from April 7 to June 30, as long as his annual earned income...

The Spanish SL vs. U.S. LLCs from a tax point of view In Spain[1]

In Spain In Spain (1) an individual can develop an economic activity as self-employed (autónomo). Autónomos must register in the Social Security and must fulfill their tax obligations. The most common form of a Spanish company is (2) the SL Sociedad Limitada, the...

CUSTOMER SATISFACTION SURVEY

Survey conducted from Nov. 18th to Dec. 31st, 2020 March 9th, 2021 15 ASPECTS ANALYZED – 71 PARTICIPATING CLIENTS THREE LEVEL OF RESULTS BREAKDOWN OF EACH CATEGORY 1 Overall satisfaction. 2 Would recommend. 3 Quality. 4 Timing. 5 Fees. 6 Client support....

Webinar “All you need to know about the Recovery Rebate Credit”

How can you receive your “Stimulus checks” with the Recovery Rebate Credit? Haven’t gotten them yet? Are they taxable? Organized by the American Club of Madrid and US Tax Consultants. Registration required: Click here CARES Act and CARES Act II EIP1: Stimulus...

Important Tax Dates on 2021

Important Tax Dates on 2021 2021 AEAT & Banco de España IRS & FinCEN HM Revenue & Customs Kingdom of Spain U.S.A. United Kingdom January, 15 Due date for Estimated Tax Form 1040-E 4th 2020 January, 20 Statistical Department of the Bank of Spain Form ETE:...

Model 720: what it is and how to fill it up.

What is Model 720? Modelo 720 is an annual report that was approved on October 29, 2012 as a modification of the tax and budgetary regulations and adaptation of the financial regulations for the intensification of actions in the prevention and fight against fraud. It...

The Beckham Law option for just arrived foreigners in Spain or the 24% flat tax rate.

General considerations before you qualify. An individual is considered tax resident in Spain when either the person remains in the Spanish territory for more than 183 days during a natural year; or has in Spain, either directly or indirectly, the main centre or the...

What you need to know about 2021 US Taxes for Expats

All U.S. Citizen you are required to file a U.S. Individual Tax Return every year, wherever in the world they live, reporting your worldwide income, even if you pay taxes in Spain. You must file the Form 1040 (Federal Income Tax), if your gross income is at least $5...

Claiming the recovery rebate credit on 1040 2020 Individual Tax Return

If you were eligible for the economic impact payment (EIP 1) and the second round at the end of December 2020 (EIP 2), known as the “Stimulus checks” but did not receive any of those or were eligible for a larger payment than you received, may be able to claim a...

Foreign assets or transactions: 720, ETE and D-6

Statements of foreign assets or transactions for residents in Spain We have in Spain three different compulsory reports of foreign assets or transactions abroad: the Modelo 720 of the Spanish Tax Agency, the modelo ETE from the Bank of Spain, and the D-6 of the...

Due dates of 2021 Fiscal obligations for US Citizens living in Spain.

The 4 fiscal obligations for expats in Spain. All U.S. Citizen you are required to file a U.S. Individual Tax Return every year, wherever in the world they live, reporting your worldwide income, even if you pay taxes in Spain. You must file (1) the Form 1040...

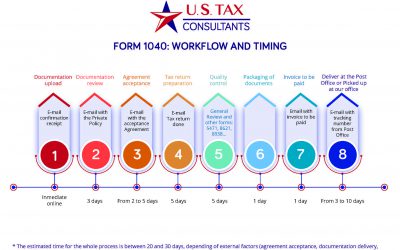

NEW TRACKING MODEL SYSTEM. KNOWING ANY TIME, THE PREPARATION STATUS OF YOUR RETURN.

In order to offer a better service, U.S. Tax Consultants has developed an information system that allows our clients to know in which phase of the preparation process your return is. A process that consists of eight different phases and of which the client will be...

Treasury and IRS will begin delivering second round of Economic Impact Payments to millions of Americans on January 4, 2021

The Internal Revenue Service and the Treasury Department will begin delivering a second round of Economic Impact Payments on January 4th, as part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 to millions of Americans who received the...

‘It’s Unacceptable,’ IRS Still Processing Millions Of 2019 Tax Returns

BOSTON (CBS) — With the uncertainty surrounding the coronavirus, Keith Wortzman would love to have his 2019 tax refund of several thousand dollars in the bank. “Any refund helps. They actually say it’s not a refund, it’s money that you overpaid,” he told WBZ-TV. But...

“Accidental Americans” in Europe against FATCA and its reporting.

The Association of Accidental Americans (AAA) has filed two legal complaints simultaneously in Belgium and Luxemburg to demand the “immediate halt to the transfer of European citizens’ personal data to the United States”. The claims relate to the countries’ adherence...

Spanish Taxes for expats and Accountancy Services

Spanish & International Tax and Accountancy Services since 1956, U.S. Tax Consultants has guided expats residents in Spain with their taxes and all other fiscal issues. We annually prepare Spanish Tax Returns, Modelo 720, quarterly report for autonomos and...

ITIN and its application process

TIN and its application process. All nonresident aliens require an ITIN to file an U.S. Individual Income Tax Return. An IRS individual taxpayer identification number (ITIN) is for U.S. federal tax purposes only. If you are a U.S. Citizen, you must use your SSN...

Six Need-To-Know 2020 Tax issues for expats.

We have selected that six need-to-know tax issues for expats to bear in mind before preparing their US Tax Returns: Mutual Funds, US bank account, CTC, tax preparation, Streamline Procedure and how to pay the IRS 1. “Fondos de Inversión” outside the U.S. All US...

![The Spanish SL vs. U.S. LLCs from a tax point of view In Spain[1]](http://ustaxconsultants.es/wp-content/uploads/2019/06/selfemployed.png)

Recent Comments