Our blog

New “CLIENTS AREA” in the U.S. TAX CONSULTANTS

New "Clients Area": all your information at a click. Offering an increasingly complete Clients service is one of the objectives of the U.S. Tax Consultants. Our new "Clients Area" is an important step to offer the most complete and up-to-date information on the...

Inheriting From the U.S. While Living Abroad

What happens if someone in the U.S. dies and leaves me an inheritance while I am living abroad? Will I owe tax in the foreign country where I live? And if so, how do bilateral treaties affect the outcome? This article is for any American abroad who expects an...

The data security of U.S. Tax Consultants’ clients

The data security of U.S. Tax Consultants' clients, personal and financial information is one of our priorities. U.S. Tax Consultants apply the most effective solutions so that our clients' information is protected and safe in the cloud. In this regard, Microsoft...

Are you a US Citizen and never lived, worked, or visited the U.S.?

Does that mean that you still must file taxes? Yes, you do if you’re considered a U.S. Person (US Citizen, Green Card Holders and Resident Aliens). You must file taxes, based on your American Citizenship. You must file your Individual Tax Return annually even if the...

Are you missing your 2019/2020 Tax Refund? You are not the only one.

Delays on processing Individual Tax Returns and Tax Refund from the 2019 and 2020 Tax seasons. According to the IRS report from May 6, on the partial results of the 2021 Filing Season, the Treasury Department still has millions of returns to process. By the end of...

The Inheritance Law in Spain for Expats – Part I (Inheritance distributions – Spanish Civil Code)

If you are Fiscal Resident in Spain, you must comply with the Spanish Inheritance Law and pay taxes in Spain over your worldwide inheritance. Inheritances Inheritances in Spain have two aspects that are ruled by two different laws, the Spanish Civil Code that...

American Expat College Savings and 529 Plans

Funding a college education is a significant expense for many families and is on the rise. For the past 50 years, the cost of tuition in the United States has increased at an average annual rate of almost six percent, nearly twice the pace of inflation. Consequently,...

FBAR – FinCEN 114. Foreign Bank Account Report

A few years ago the Foreign Bank Account Report (FBAR) changed from using the TD F 90-22.1 paper form to the online FinCEN Form 114. It is used to report financial interest in or signature authority over foreign financial accounts and is an information return only, so...

IRS Amnesty – Streamlined Filing Compliance Procedure for delinquent filers

U.S. Persons (U.S. Citizens, Green Card Holders and Resident Aliens) are required to file annually regardless of where their income is earned, where in world they live, whether or not the U.S. has a Tax Treaty with that country and whether or not they also pay Foreign...

ACM Webinar: “All you need to know about the Inhertance Law for Expats Residents in Spain.”

ACM Webinar, May 26th, 2021 at 19:00 “All you need to know about the Inhertance Law for Expats Residents in Spain.” Organized by the American Club of Madrid and Goy GENTILE Abogados The American Club of Madrid will continue this season’s Webinars with a detailed...

IRS is holding millions of tax returns, delaying refunds

By Aimee Picchi - CBS News April 25th The IRS is holding 29 million tax returns for manual processing, delaying tax refunds for many Americans, according to the National Taxpayer Advocate, an independent arm of the tax agency that looks out for consumers' interest....

Modelo 100 IRPF

Spanish Income Tax Return modelo 100 IRPF for residents in Spain and Wealth Tax (Modelo 714) for residents and owners of good or right located in Spain. All Spanish fiscal residents must file Modelo 100 IRPF from April 7 to June 30, as long as his annual earned income...

The Spanish SL vs. U.S. LLCs from a tax point of view In Spain[1]

In Spain In Spain (1) an individual can develop an economic activity as self-employed (autónomo). Autónomos must register in the Social Security and must fulfill their tax obligations. The most common form of a Spanish company is (2) the SL Sociedad Limitada, the...

CUSTOMER SATISFACTION SURVEY

Survey conducted from Nov. 18th to Dec. 31st, 2020 March 9th, 2021 15 ASPECTS ANALYZED – 71 PARTICIPATING CLIENTS THREE LEVEL OF RESULTS BREAKDOWN OF EACH CATEGORY 1 Overall satisfaction. 2 Would recommend. 3 Quality. 4 Timing. 5 Fees. 6 Client support....

Webinar “All you need to know about the Recovery Rebate Credit”

How can you receive your “Stimulus checks” with the Recovery Rebate Credit? Haven’t gotten them yet? Are they taxable? Organized by the American Club of Madrid and US Tax Consultants. Registration required: Click here CARES Act and CARES Act II EIP1: Stimulus...

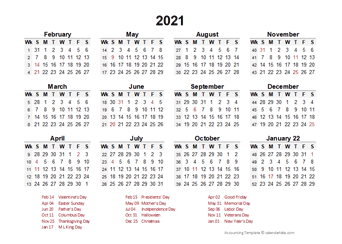

Important Tax Dates on 2021

Important Tax Dates on 2021 2021 AEAT & Banco de España IRS & FinCEN HM Revenue & Customs Kingdom of Spain U.S.A. United Kingdom January, 15 Due date for Estimated Tax Form 1040-E 4th 2020 January, 20 Statistical Department of the Bank of Spain Form ETE:...

Model 720: what it is and how to fill it up.

What is Model 720? Modelo 720 is an annual report that was approved on October 29, 2012 as a modification of the tax and budgetary regulations and adaptation of the financial regulations for the intensification of actions in the prevention and fight against fraud. It...

The Beckham Law option for just arrived foreigners in Spain or the 24% flat tax rate.

General considerations before you qualify. An individual is considered tax resident in Spain when either the person remains in the Spanish territory for more than 183 days during a natural year; or has in Spain, either directly or indirectly, the main centre or the...

What you need to know about 2021 US Taxes for Expats

All U.S. Citizen you are required to file a U.S. Individual Tax Return every year, wherever in the world they live, reporting your worldwide income, even if you pay taxes in Spain. You must file the Form 1040 (Federal Income Tax), if your gross income is at least $5...

Claiming the recovery rebate credit on 1040 2020 Individual Tax Return

If you were eligible for the economic impact payment (EIP 1) and the second round at the end of December 2020 (EIP 2), known as the “Stimulus checks” but did not receive any of those or were eligible for a larger payment than you received, may be able to claim a...

![The Spanish SL vs. U.S. LLCs from a tax point of view In Spain[1]](http://ustaxconsultants.es/wp-content/uploads/2019/06/selfemployed.png)

Recent Comments