Our blog

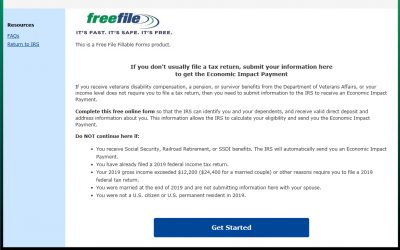

Non filers might also get the “Stimulus check”!!!

The IRS launched a solution that allows taxpayers who don’t normally file a tax return (i.e. income is under the filing threshold) to provide the minimum information required for purposes of receiving Economic Impact Payments (commonly known as stimulus checks). This...

Stimulus Checks COVID-19: Who Is Eligible and How Much Will They Be?

Agreement reached early on Wednesday will give money to most Americans, small-business loans and help for hard-hit industries. Senate plan would send $1,200 checks to many, including Social Security recipients The Senate voted unanimously late Wednesday (March 26th)...

IRS Tax Filing and Payments Delayed Until July 15, 2020

COVID-19 Pandemic delays and date changes. President Trump declared a national state of emergency due to the COVID-19 pandemic. The IRS has issued guidance that the tax deadline will move to July 15, 2020. We expect this pandemic to cause serious delays in processing...

Prestación extraordinaria por cese de actividad para trabajadores autónomos medidas adoptadas por el coronavirus COVID-19. Real Decreto Ley 8/2020

Beneficiarios: · Los que hayan suspendido sus actividades, según el Real Decreto 463/2020 (declaración estado de alarma). En el mismo se especifica la relación de actividades cuya apertura al público se suspende, así mismo el Real Decreto 465/2020 aclara algunos...

Same due date as Form 1040. Do not forget it!

The Foreign Bank Accounts (FBAR) Report changed from using the TD F 90-22.1 paper form to the online FinCEN Form 114. It is used to report financial interest in or signature authority over foreign financial accounts and is an information return only, so there will be...

Do not wait until last minute!

April 2nd will start the filing season for the Spanish Modelo 100 (IRPF), until June 31st. We will need all your W2 and 1099 from the US financial institutions. The individual tax return campaign in Spain for 2019 will start on April 2nd. We plan to download the...

Form 1040. If you have not sent us the information, this is the moment!

The due date for the payment of your taxes for 2019 is April 15th. LAST NOTICE MARCH 20, 2020 The due date for filing your return has an automatic extension until June 15th, and for our clients we always ask for the extension until October 15th. Form 1040 is the...

Celebrating our 55th anniversary with a new logo!

(En español a continuación) Celebrating our 55th anniversary with a new logo! Our 55th anniversary has a very special significance for us. And to celebrate it, we have prepared different actions and events that we will be developing throughout this year. Among them we...

Only 10 days more to file Modelo 720

It is only an informative declaration, but it has severe penalties. If you were fiscal resident of Spain during 2019 and you have financial accounts or real estate properties outside Spain, you must file it. Modelo 720 is an Informative Declaration on goods and rights...

We continue working for our clients…

At U.S. TAX Consultants WE CONTINUE WORKING WITH OUR CLIENTS…. FROM HOME We continue providing our services, via internet during the State of Alarm in Spain. This will in no way affect the preparation of your returns or any other services we provide. Our telephones,...

The US Tax Consultants team is in a period of growth, increasing the strength of its team by taking on several highly qualified professionals.

US Tax Consultants has recently strengthened its team of highly qualified professionals with the incorporation of 3 new consultants. New logo. (En español a continuación) U.S. TAX CONSULTANTS REINFORCES ITS PROFESSIONAL TEAM Recently new professionals have joined the...

How they know if you cheat on your return

By Tina Orem - Market Watch Mailboxes are flooded with tax forms every year around this time, and many of them can be confusing, feel unnecessary or involve seemingly trivial amounts of money. But before succumbing to the urge to shove those pieces of paper into a...

Bases legales sorteo “55 aniversario” de US Tax Consultants en Facebook

US Tax Consultants, es una marca de New Media Lab S.L. con C.I.F. B85709384 con domicilio social Travesía de las Cañas, 2 - 28043 Madrid, organiza un Sorteo Promocional de ámbito nacional denominado “Sorteo 55 aniversario” (en adelante el “Sorteo Promocional”)...

NTK Seminar: American Club of Madrid Communication series ” Como hablar en público” por Alfredo Urdaci

Como parte del programa anual de seminarios del American Club of Madrid, tenemos este seminario como parte de la serie de Comunicacion que es imprescindible para todos los que nos hemos enfrentado alguna vez a hablar en público. Entrada libre, sólo hay que registrase....

IRS Scams: Dirty Dozen of Tax Return Fraud for 2020

Each year, the IRS releases the Dirty Dozen – a list of the largest tax scams they saw for that year’s taxes. The IRS scams list reads like a playbook from the past, with phishing, identity theft, and fake charities making the top 12. These common scams are increasing...

Tax season is coming, and it might be as chaotic as last year

By Laura Davison Capitol Hill Tax reporter, Bloomberg News. Filing taxes last year was a nightmare for taxpayers, their accountants and the Internal Revenue Service. This year might not be much better. The IRS is still working to issue guidance for the changes to the...

Reasons for people to file a 2019 U.S. Tax Return

While many people are required to file a tax return, it’s a good idea for everyone to determine if they should file. Some people with low income are not required to file, but will need to do so if they can get a tax refund. Here are five tips for taxpayers who are...

Filing Season for Individual Filers Opens Jan. 27th – New Gig Economy Tax Center – IRS Whistleblower

The IRS confirmed this week that the 2020 tax season will start for individual tax return filers on Monday, Jan. 27. The deadline to file 2019 tax returns and pay any tax owed is Wednesday, April 15; and for those living abroad the filling deadline will be June 15th....

ACM Business Luncheon on US Taxes: Form 8621 and Guilty Tax or the expats’ nightmare

US Taxes: Form 8621 and Guilty Tax or the expats' nightmare U.S. expats are already subject to significantly more onerous tax rules than U.S. citizens living in the U.S., among which the Passive Foreign Investment Company ("PFIC") is one of the most notorious. U.S....

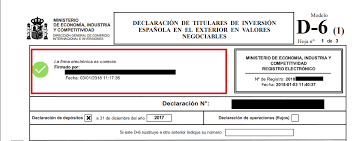

Modelo 720, Modelo ETE and Modelo D-6: Statements of foreign assets or transactions.

Modelo 720 Report of asset abroad when exceeding of value €50,000. Please refer to complete information in this website //ustaxconsultants.es/services/modelo-720/ Modelo ETE The economic transactions and the balances of financial assets and liabilities abroad of...

Recent Comments