Our blog

“ACM Need to Know Seminar”: Fiscal Obligations for US Citizens residents in Spain

Thu, February 28, 2019 7:00 PM – 9:00 PM Centro de Estudios Sagardoy Abogados - Calle Tutor, 24 28008 MadridEverything you need to know about taxes in Spain and in the U.S.A. for your tax returns 2018.TCJA - Tax Cuts and Jobs Act of 2017. Trump’s Fiscal reform...

“ACM Need to Know Seminar”: Investing as American Abroad

Thu, February 21, 2019 7:00 PM – 9:00 PM Universidad San Pablo CEU - Calle Julián Romea, 23 28003 Madrid (Fac. Económicas y Empresariales)Investing as an American Abroad: What You Need to Know Now to Grow Your Savings and Avoid Conflicts with the IRS: Why you must...

“ACM Need to Know Seminar” Modelo 720 & FATCA: How it Affects Expats

Wed, February 6, 2019 - 7:00 PM – 9:00 PM Universidad San Pablo CEU - Calle Julián Romea, 23 28003 Madrid (Fac. Económicas y Empresariales)Join us for this VERY important informational session. Know your legal responsibilities!Modelo 720 & FATCA: How it affects...

Where is my refund from last year?

Can Trump’s administration really send out tax refunds during a shutdown? It’s not clear. The Trump administration says tax refunds will go out. But some experts are skeptical. President Donald Trump’s administration said earlier this week that it will still send out...

Provision of Tax Cuts and Jobs Act in detail (1)

1. New Individual and Capital Gains Tax Rates:The Act maintains the current seven individual tax brackets but generally reduces the applicable tax rates. A comparison of the individual tax brackets that would have been in effect for 2018 prior to passage of the Act...

American Club of Madrid. NTK Seminars: Investing as an American Abroad: What You Need to Know Now.

Free Requiredregistration:https://bit.ly/2Q3n1Fh February21, 2018 19:00 at Universidad CEU San Pablo (Fac. Económicas y Empresariales)c/ Julian Romea, 23 – 28008 Madrid Presenters: David Kuenzi (Thun Financial Advisors, Madison WI) & James Levy (ClearwaterPrivate...

American Club of Madrid. NTK Seminars: Modelo 720 & FATCA: How it affects us. Future year’s returns

Free.Required registration: https://bit.ly/2Ebfaio February6, 2019 19:00 at Universidad CEU San Pablo (Fac. Económicas y Empresariales)c/ Julian Romea, 23 – 28008 Madrid Presenters: Alejandra Pastor (Sagardoy Abogados) & AntonioRodriguez (US Tax Consultants)...

American Club of Madrid, NTK Seminars: Expats-VISAs, Nationality, and Children Born in Spain…

FreeRequired registration: https://bit.ly/2QerTXZ January24, 2019 19:00 at Sagardoy Abogados Training Center c/ Tutor, 24 – 28008 Madrid- Maximum 40 pax Presenter: Ana Garicano (Partner at Sagardoy Abogados) Expats-VISAs,Nationality, and Children Born in Spain...:...

IRS: No required to declare!

Here's why some retirees no longer have to file a tax return Retirees whose only source of income is Social Security generally will not owe any federal taxes and therefore don't need to file a return with the IRS.Even some people with taxable sources of income end up...

Three Common Family Tax Mistakes

When it comes to transactions between family members, the tax laws are frequently overlooked, if not outright trampled upon. The following are three commonly encountered situations and the tax ramifications associated with each. Renting to A Relative – When a...

All You Need to Know About the Tax Evasion Statute

As defined within the 26 United States Code section 7201 by the Internal Revenue Code, failure to report taxes accurately, failure to report taxes and failure to pay taxes are all forms of tax evasion. In order to establish a case of tax evasion against you the...

American Club of Madrid “Need to Know seminars”: The Spain-U.S.A. Double Taxation Treaty

The Spain-U.S.A. Double Taxation Treaty - https://bit.ly/2xYBd7t November 29, 2018 19:00 at Universidad CEU San Pablo (Fac. Económicas y Empresariales) Aula Magna c/ Julian Romea, 23 – 28008 Madrid - Maximum 100 pax. Presenters: Lucía Goy (CEO Goy Gentil Abogados)...

Everything You Need to Know About the New 2018 Tax Form.

Failing to file will cost you more than failing to pay your taxes. You should to file your return on time, even if you do not owe anything to the IRS. The penalty for failing to file is significantly more than the penalty for failing to pay. The failure-to-file...

The Section 965 “transition tax” is unconstitutional

According to the paper published by the Yale Journal on Regulation Bulleting , Vol. 36, 2018 by SeanP McElroy, the mandatory "repatriation tax is unconstitutional. In late 2017, Congress passed the first major tax reform in over three decades. This Essay considers the...

The Section 965 ” Transition Tax” today

Yesterday, October 22, American Citizens Abroad, Inc. presented oral testimony at the public hearing held by the IRS and Treasury Department, “Guidance Regarding the Transition Tax Under Section 965 and Related Provisions (Ref-104266-18)”. ACA has gone on record twice...

LAS PRESTACIONES POR MATERNIDAD ESTÁN EXENTAS DE TRIBUTAR POR IRPF

El Tribunal Supremo confirma en su reciente Sentencia de 3 de octubre como doctrina legal, que las prestaciones públicas por maternidad percibidas de la Seguridad Social están exentas del Impuesto sobre la Renta de las Personas Físicas. ¿Qué consecuencias tiene para...

Passive Foreign Investment Company (PFIC)

Passive Foreign Investment Company (PFIC) A foreign entity/form of investment is a PFIC if it meets either the income or asset test described below. Income test. 75% or more of the corporation’s gross income for its taxable year is passive income (as defined in...

Options Available for U.S. Taxpayers with Undisclosed Foreign Financial Assets

The implementation of FATCA (January 1st, 2018) and the ongoing efforts of the IRS and the Department of Justice to ensure compliance by those with U.S. tax obligations have raised awareness of U.S. tax and information reporting obligations with respect to non-U.S....

The New IRS Form 1040 for 2019

The Internal Revenue Service has debuted a prototype of the new Form 1040 that hundreds of millions of Americans use to file their annual taxes. The new "postcard sized" form will be used for the 2018 income tax year, which most Americans will file by April 15, 2019....

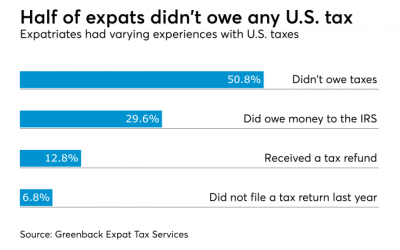

US Expats object to U.S. taxes

A growing proportion of U.S.-born expatriates do not feel they should be required to file taxes while they live abroad and about one-fifth of them are considering renouncing their U.S. citizenship, according to a new survey. The survey, by Greenback Expat Tax...

Recent Comments