Our blog

Claiming the Foreign Earned Income Exclusion for Nonfilers

The Foreign Earned Income Exclusion Americans living and working abroad can make up to $101,300 of earned income tax-free. Earned income is what you get paid for working — wages or self-employment income. This is the foreign earned income exclusion. It is great. Your...

The $1.29 Trillion Tax Break Donald Trump Is Proposing

As part of his plan to cut taxes for all Americans, Donald Trump's proposals calls for more than doubling the standard deduction for single and married taxpayers. While this certainly would save lots of people money, it's not quite as big of a tax cut as it sounds at...

10 Steps to Avoiding Tax-Return Identity Theft

Someone who steals your identity for tax purposes is probably not intending to pay your back taxes for you. He or she is after your tax refund. Make sure your refund ends up in your hands and not that of a thief by practicing a few simple habits that can protect your...

How to Estimate Property Taxes

Most states allow their city, town and other local governments to raise revenue by charging homeowners a property tax. Since property tax rates and formulas can vary significantly in different areas of the country, there isn’t a single calculation that all homeowners...

¿Cómo acceder a la universidad en U.S.A.?

Ready to practice your English?! 😉 Access USA hopes you liked the guide "10 Claves para el acceso a la universidad en USA" and that it was able to answer some of your questions. Access USA still has lots of additional information to share with you, so stay in touch,...

As Holidays Approach, IRS Reminds Taxpayers of Refund Delays in 2017

WASHINGTON — As the holidays approach, the Internal Revenue Service today reminded taxpayers to remember that a new law requires the IRS to hold refunds until mid-February in 2017 for people claiming the Earned Income Tax Credit or the Additional Child Tax Credit. In...

ACA Solves Banking Problems for Americans Abroad

Americans living abroad have a hard time keeping U.S. bank accounts open. As soon as the bank (or investment firm *cough* Merrill Lynch *cough*) finds out you are living abroad, you are apt to get your account closed. Subterfuge is a common solution. (Subterfuge is...

Brexit e impuestos para no residentes

Mayor tributación en ISD e IRNR Brexit. La salida de Gran Bretaña de la UE tendrá repercusiones fiscales negativas para los ciudadanos británicos con propiedades en España, tanto en el caso del Impuesto sobre la Renta de no Residentes (IRNR), como en el del Impuesto...

¿Cómo acceder a la universidad en U.S.A.? – Access USA

Talleres gratuitos para padres y alumnos - Access USA A partir del mes de diciembre Access USA ofrece unos TALLERES GRATUITOS sobre el acceso a la universidad en los Estados Unidos. Estos talleres informativos, de 30 - 45 minutos de duración, están dirigidos a...

If you don’t pay your US Taxes you can lose your passport

We have been contact by a lot of ordinary Americans living in Spain, telling us that they have not filed US taxes with the IRS (Internal Revenue Service) since they arrived here. They work in Spain, save their money in the bank and they pay taxes in Spain just as any...

Back to School? Learn about Tax Credits for Education

US Tax Consultants (NML Consultores) and Access USA will be offering seminars this year on the financial aid process. If you pay for college in 2016, you may receive some tax savings on your federal tax return, even if you’re studying outside of the U.S. Both the...

Summer 2016 Statistics of Income Bulletin

The Internal Revenue Service today announced that the summer 2016 issue of the Statistics of Income Bulletin is available on IRS.gov. The Statistics of Income (SOI) Division produces the online Bulletin quarterly, providing the most recent data available from various...

Financial institutions poorly prepared for automatic information exchange

Financial institutions are reporting a number of challenges over compliance with new OECD requirements related to the automatic exchange of information (AEOI) on client bank accounts in foreign jurisdictions, exacerbated by problems complying with the US Foreign...

Reporting Foreign Bank Accounts

Dickinson Wright tax Blog USA August 15 2016 The IRS has signaled its intention to tighten the thumb screws a bit further on the reporting of foreign bank accounts, in recently published Announcement 2016-27. Under the so-called FATCA (Foreign Account Tax Compliance...

High Inaccuracy Rate Seen in FATCA Filings

Wilmington, Mass. (August 19, 2016) By Michael Cohn Less than half of filings for the Foreign Account Tax Compliance Act have been accurate, according to a new survey. The survey, conducted by the Aberdeen Group on behalf of the software company Sovos Compliance,...

U.S. Tax Information Session in Madrid – Monday March 14th 5pm

U.S. Tax Information Session in Madrid with the ACM - American Club of Madrid We will have a sort presentation on the following issues: Spanish and US taxes for US citizens who are residents in Spain. Tax Treaty on no-double taxation. Current situation and future of...

U.S. Tax Information Session at American Women’s Club – March 7th 2016.

U.S. Tax Information Session at American Women’s Club We will have a sort presentation on the following issues: Spanish and US taxes for US citizens who are residents in Spain. Tax Treaty on no-double taxation. Current situation and future of the Foreign Bank Account...

¿Te ha enviado una carta el Banco? – Have you received a letter from your bank?

Los bancos españoles se están poniendo en contacto por carta con algunos clientes, con el objeto de cumplir el acuerdo internacional firmado el 14 de mayo de 2013 entre el Reino de España y los Estados Unidos de América, para la mejora del cumplimiento fiscal...

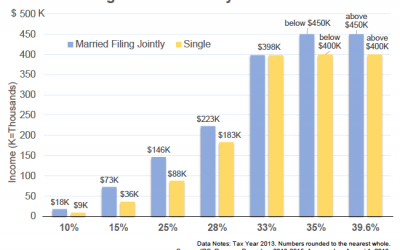

2016 Taxes: What’s on Deck for Your Investments?

Compared with the "fiscal cliff" and other year-end escapades, the tax-related drama in Washington has been pretty subdued in recent years. Dividend and capital gains tax rates have stayed the same, and the federal estate tax will still only affect the uber-rich....

Do you plan to expatriate during 2016?

For those of you who are thinking about expatriation in 2016, this is a perfect time to start doing the footwork. When should you renounce? There are four major factors that drive the timing of your expatriation: Covered expatriate status (you may need some time to...

Recent Comments