Our blog

American Club of Madrid “Need to Know seminars”: The Spain-U.S.A. Double Taxation Treaty

The Spain-U.S.A. Double Taxation Treaty - https://bit.ly/2xYBd7t November 29, 2018 19:00 at Universidad CEU San Pablo (Fac. Económicas y Empresariales) Aula Magna c/ Julian Romea, 23 – 28008 Madrid - Maximum 100 pax. Presenters: Lucía Goy (CEO Goy Gentil Abogados)...

Everything You Need to Know About the New 2018 Tax Form.

Failing to file will cost you more than failing to pay your taxes. You should to file your return on time, even if you do not owe anything to the IRS. The penalty for failing to file is significantly more than the penalty for failing to pay. The failure-to-file...

The Section 965 “transition tax” is unconstitutional

According to the paper published by the Yale Journal on Regulation Bulleting , Vol. 36, 2018 by SeanP McElroy, the mandatory "repatriation tax is unconstitutional. In late 2017, Congress passed the first major tax reform in over three decades. This Essay considers the...

The Section 965 ” Transition Tax” today

Yesterday, October 22, American Citizens Abroad, Inc. presented oral testimony at the public hearing held by the IRS and Treasury Department, “Guidance Regarding the Transition Tax Under Section 965 and Related Provisions (Ref-104266-18)”. ACA has gone on record twice...

LAS PRESTACIONES POR MATERNIDAD ESTÁN EXENTAS DE TRIBUTAR POR IRPF

El Tribunal Supremo confirma en su reciente Sentencia de 3 de octubre como doctrina legal, que las prestaciones públicas por maternidad percibidas de la Seguridad Social están exentas del Impuesto sobre la Renta de las Personas Físicas. ¿Qué consecuencias tiene para...

Passive Foreign Investment Company (PFIC)

Passive Foreign Investment Company (PFIC) A foreign entity/form of investment is a PFIC if it meets either the income or asset test described below. Income test. 75% or more of the corporation’s gross income for its taxable year is passive income (as defined in...

Options Available for U.S. Taxpayers with Undisclosed Foreign Financial Assets

The implementation of FATCA (January 1st, 2018) and the ongoing efforts of the IRS and the Department of Justice to ensure compliance by those with U.S. tax obligations have raised awareness of U.S. tax and information reporting obligations with respect to non-U.S....

The New IRS Form 1040 for 2019

The Internal Revenue Service has debuted a prototype of the new Form 1040 that hundreds of millions of Americans use to file their annual taxes. The new "postcard sized" form will be used for the 2018 income tax year, which most Americans will file by April 15, 2019....

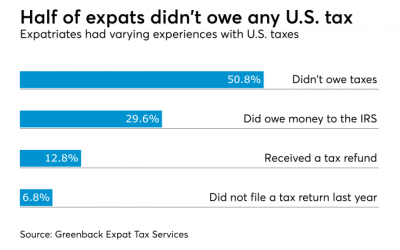

US Expats object to U.S. taxes

A growing proportion of U.S.-born expatriates do not feel they should be required to file taxes while they live abroad and about one-fifth of them are considering renouncing their U.S. citizenship, according to a new survey. The survey, by Greenback Expat Tax...

IRS Announces End of Offshore Voluntary Disclosure Program – El IRS anuncia el final del programa de amnistía tributaria para ciudadanos americanos

IRS Announces End of Offshore Voluntary Disclosure Program En español a continuación The Internal Revenue Service announced on March 13th that it will begin to ramp down the 2014 Offshore Voluntary Disclosure Program (OVDP) and close the program on Sept. 28, 2018. By...

Guide to College Tuition Tax Breaks for 2018

During the tax reform process, there were several proposals that called for modifying or eliminating certain education tax breaks. Fortunately for American college students and their families, most of the major tuition tax breaks are still in place for the 2018 tax...

Are you a U.S. Citizen or Green Card holder?

All Americans are required to file annually the U.S. Individual Tax Return, wherever in the world they live. Here’s what US expats need to know about filing US taxes from abroad. Expats have an automatic filing extension until June 15th, with a further extension...

Bring-A-Friend – Get Rewarded!

If you enjoyed working with us and have just 10 seconds to spare, we’d love to offer you a 10% off prep services. What’s the Catch? There isn’t one! Based on the feedback from customer like you, we’ve made a change to our Refer-A-Friend program. A gift card is nice,...

ACM “Need to Know Seminars” Spanish and U.S. fiscal obligations of U.S. citizens residing in Spain. MADRID

April 26th – Thursday 19:00 at Sagardoy Abogados (c/Tutor, 24 - Madrid) American Club of Madrid (ACM) NEED TO KNOW SEMINAR. Everything you need to know about taxes in Spain and in the U.S.A. for your tax returns 2017 for US citizen’s residents in Spain. Form 1040:...

ACM “Need to Know Seminars” Spanish and U.S. fiscal obligations of U.S. citizens residing in Spain. SEVILLA

March 15th – Thursday 18:00 at Centro Cívico Torre del Agua (Plaza Vicente Aleixandre - 41013 Sevilla) Everything you need to know about taxes in Spain and in the U.S.A. for your tax returns 2017 for US citizen’s residents in Spain. Form 1040: Worldwide income,...

ACM “Need to Know Seminar” U.S. Passports, renewals, VISAs in Spain

March 7th - Wednesday 19:00 at Sagardoy Abogados (c/Tutor, 24 - Madrid) American Club of Madrid (ACM) NEED TO KNOW SEMINAR. You need to know about the recent changes in the new requirements/options for passport renewal, and the requirements/procedure for reporting...

ACM “Need to Know Seminar” Modelo 720 – Report of Assets Abroad

Date and Time: Thu, February 8, 2018 - 7:00 PM – 8:30 PM Location: Sagardoy Abogados - Calle Tutor, 27 28008 Madrid Report of all assets abroad. This form must be filed by all Spanish residents owning assets abroad. It is required to file this form every year before...

What to expect from the IRS during the government shutdown

The shutdown started nine days before the Jan. 29 scheduled start of tax season, and it is unclear how tax season will be affected. During the last federal government shutdown, in 2013, the IRS continued to process e-filed tax returns and paper returns that contained...

Modelo 720: Este año toca regularizar

Son muchísimas las personas residentes en España, españoles y extranjeros, que se encuentran verdaderamente aterrorizadas porque tenían bienes en el extranjero (cuentas, valores o inmuebles) con valor superior a 50.000€ y no informaron sobre los mismos a la Hacienda...

2018 Tax Filing Season Begins Jan. 29, Tax Returns Due April 17

The Internal Revenue Service has announced that the nation’s tax season will begin Monday, Jan. 29, 2018 and reminded taxpayers claiming certain tax credits that refunds won’t be available before late February. The IRS will begin accepting tax returns on Jan. 29, with...

Recent Comments