por Antonio Rodriguez | Ene 10, 2021 | AEAT, FATCA, FBAR, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Modelo 720, Spanish Tax Return for non-residents, US Tax Return 1040 / 1040NR

The 4 fiscal obligations for expats in Spain. All U.S. Citizen you are required to file a U.S. Individual Tax Return every year, wherever in the world they live, reporting your worldwide income, even if you pay taxes in Spain. You must file (1) the Form 1040...

por Antonio Rodriguez | Ene 6, 2021 | AEAT, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Modelo 720, US Tax Return 1040 / 1040NR

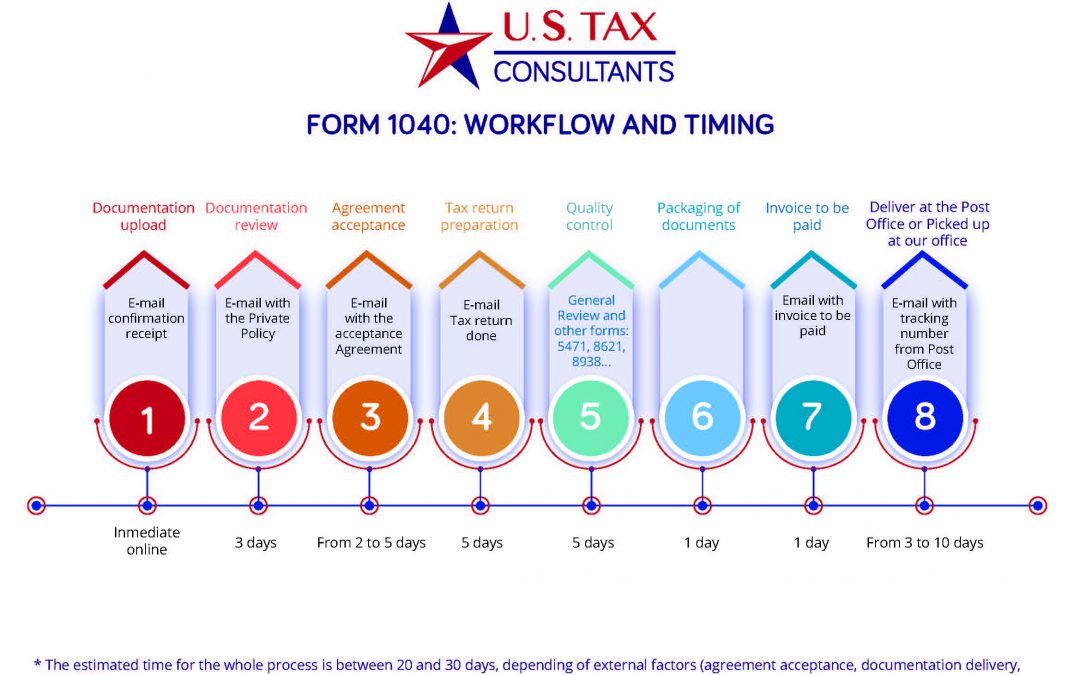

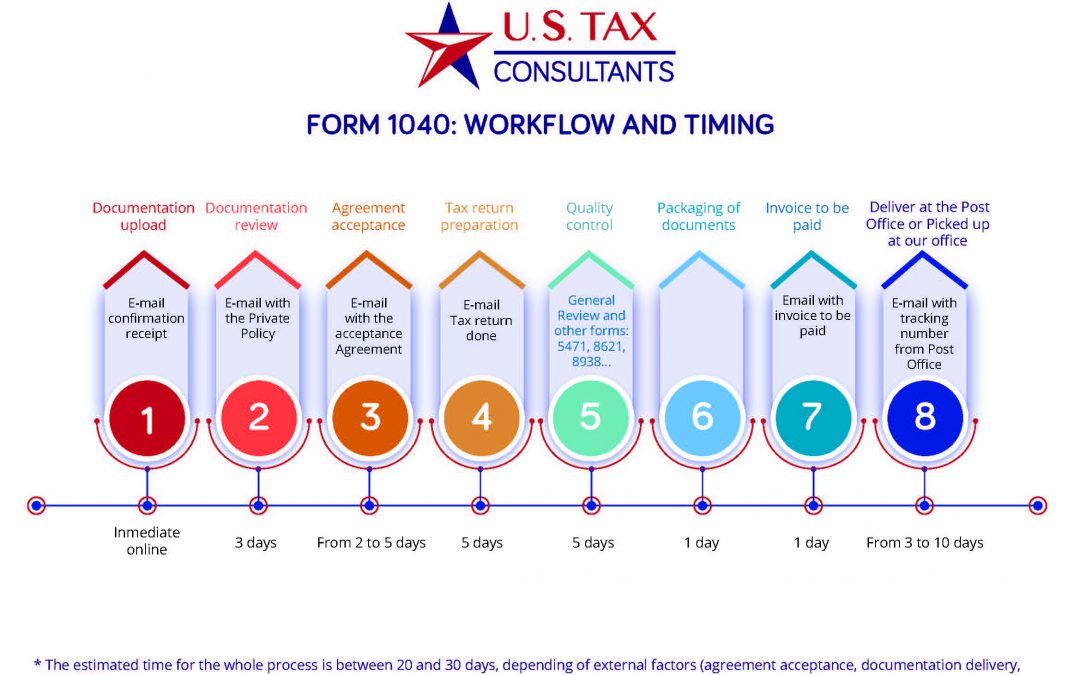

In order to offer a better service, U.S. Tax Consultants has developed an information system that allows our clients to know in which phase of the preparation process your return is. A process that consists of eight different phases and of which the client will be...

por Antonio Rodriguez | Nov 16, 2020 | Business, FBAR, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Uncategorized, US Tax Return 1040 / 1040NR

We have selected that six need-to-know tax issues for expats to bear in mind before preparing their US Tax Returns: Mutual Funds, US bank account, CTC, tax preparation, Streamline Procedure and how to pay the IRS 1. “Fondos de Inversión” outside the U.S. All US...

por Antonio Rodriguez | Sep 11, 2019 | Modelo 720

The Tax Administration in Spain went from 3,486 penalties to taxpayers for late declaration of the modelo 720 in 2015 to 0 so far in 2019: These are the formal ‘automatic’ sanctions for late statements, of 100 euros for undeclared data, with a minimum of...

por Antonio Rodriguez | Mar 2, 2019 | FATCA, FBAR, IRPF Spanish Tax Return, IRS - Internal Revenue Service, Modelo 720

When: March 12, 2019 at 19h00 Where: The Business Center of Mutua Madrileña, 33 Paseo de la Castellana, Madrid.Registration required: https://bit.ly/2Eta1jqThe Stanford Alumni Association of Spain invites you to hear Marylouise Serrato, Executive Director of...

Comentarios recientes